Sweat Equity Shares

- by K Gopalakrishnan Nair

- Posted on January 22, 2023

Sec 2(88) of Companies Act, 2013 Defines Sweat Equity Shares

“Sweat Equity shares means such equity shares as are issued by a company to its

directors or Employees at a discount or for consideration, other than cash, for

providing their know-how or making available rights in the nature of intellectual

property rights or value additions.”

Employees, Directors, KMP, who putting the sweat in the company in order to make

the company better means make the company better-functioning by providing

technical know-how, Intellectual guides and value additions.

In addition to compensation the company has to give something else for the

employees to motivate them and the best way to motivate them is giving a share of

the company itself and that is Sweat Equity Share.

There are 2 scenarios that equity shares of the company can be issued in discount

and they are.

- Issuing sweat equity shares

- Issuing equity shares to the creditors of the company in view of their debt.

What is Intellectual Property?

Intellectual property (IP) refers to creations of the minds, such as inventions, literary

and artistic works, designs, symbols, names and images etc used in commerce.

IP is protected in law by, for example, patents, copyrights and trademarks, which

enable people to earn recognition or financial benefit from what they invent or

create. By striking the right balance between the interests of innovators and the

wider public interest, the IP system aims to foster an environment in which creativity

and innovation can flourish.

Value addition: Definition.

The actual or anticipated economic benefits derived or to be derived by the company

from an expert or a professional for providing know-how or making available rights

in the nature of intellectual property rights, by such person.

Note: Consideration for value Additions not to be paid or included in the normal

remuneration payable under the contract of employment, in the case of an

employee.

Note: Consideration for value Additions not to be paid or included in the normal remuneration payable under the contract of employment, in the case of an employee.

Importance of Sweat Equity Shares

The issuance of sweat equity shares can be beneficial for both employees and companies at the same time. Some of the significances are discussed below:

In their initial days, most start-ups or business enterprises cannot incentive or reward employees with monetary benefits. Therefore, such companies issue sweat equity shares in the names of employees.

Sweat equity shares are issued to reduce the additional financial burden and to have continued control of expenses and budget.

Employees/ Directors get directly involved in the operations of the company.

Issuance of Sweat Equity shares can encourage and motivate employees to stay with companies for longer. These issuance can also boost the morale of other employees, increasing the efficiency and productivity of business operations.

Employees with sweat equity shares are better equipped to absorb the economic shock and handle pay cuts during challenging times.

Periodic salary raises can be avoided by issuing sweat equity shares to high-performing individuals.

The gains on the increase in prices of the shares over the period of time can be enjoyed by the employees/directors, and even dividends are received on the company’s profit.

Employee means

- A permanent employee of the company who has been working in India or outside India; or

- A director of the company, whether a whole-time director or not; or

- An employee or a director as defined in sub-clauses(a) or (b) of a subsidiary in India or outside India, or of a holding company of the company

Consideration other than cash means,

For example

An employee of a tyre manufacturing company discovers that the nylon coating given to tyre can be reduced and the quality of tyre retains the same as before by this the company have saved a huge sum of money. Though the idea was given by the employee, the company gives him a part of stake of the company as sweaty equity shares as a consideration other than salary.

How will you assign value for non-cash consideration?

The sweat equity shares to be issued shall be valued at a price determined by a registered valuer as fair price giving justification for such valuation.

The valuation of intellectual property rights or of know how or value additions for which sweat equity shares are to be issued, shall be carried out by a registered valuer, who shall provide a proper report addressed to the Board of Directors with justification for such valuation.

Copy of both the valuation reports should be sent to the shareholders along with the notice of the general meeting.

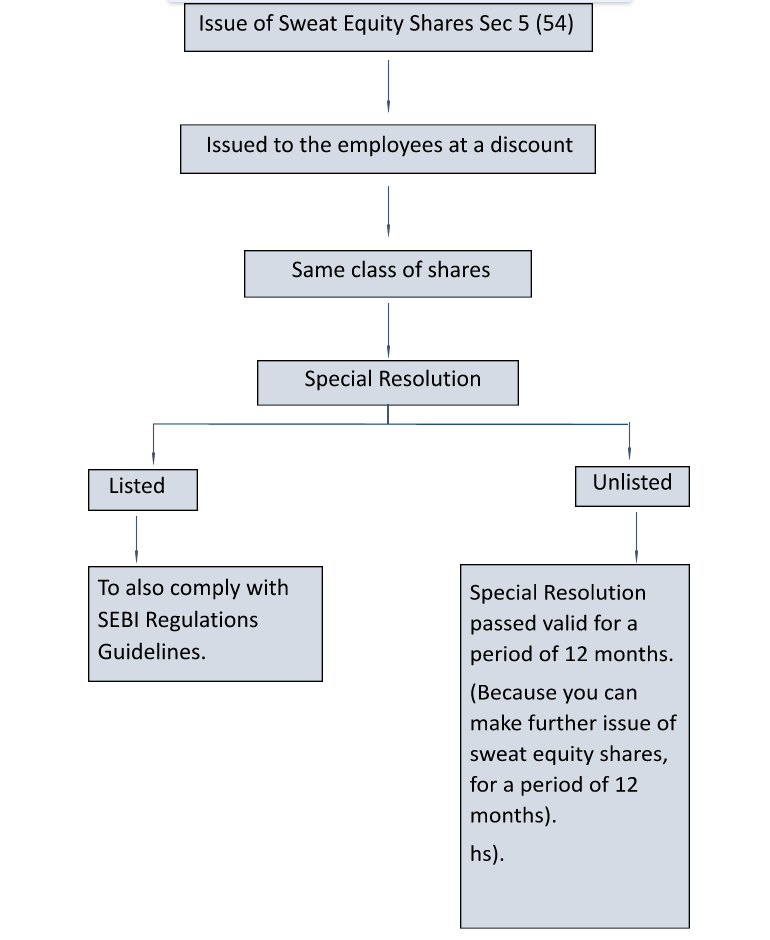

Procedures of issuance of sweat equity shares. (Section 54)

Board Meeting is called serving the notice at least 7 days before to discuss the proposal of issue of Sweat Equity Shares and fix up the date for EGM

Issue notice of General Meeting at least 21 days prior to the date of meeting with the Explanatory statement annexed along

Pass special resolution for the issue of Sweat Equity Shares in the General Meeting called. File the form MGT-14 with Registrar of Companies (ROC) within 30 days of passing the resolution.

Call the next Board Meeting for passing the resolution for allotment of shares. Once the resolution is passed, file form PAS – 3 with Registrar (ROC) within 30 days. Shares must be issued within 12 months from the date of passing the special resolution.

After the allotment of shares, Company shall maintain a register of sweat equity shares in form SH-3 with all details and particulars of the shares allotted.

What is MGT-14?

Form MGT 14 was introduced in the Companies Act of 2013 with the objective of filing certain resolutions with the Registrar of Companies. Such resolutions must be filed after passing of the same at the meeting held by the Board/Shareholders/Creditors of the company.

Why is MGT-14 Mandatory?

- MGT-14 needs to be filed by a company with the Registrar of Companies (ROC) in accordance with section 94(1) and 117(1) of the Companies Act 2013 and the rules made thereunder. However, the private companies are exempted from filing of Board Resolutions.

- It is an E-Form

- There are 3 Annexures to this form

- Annexure A (For Board Resolution)

- Annexure B (For Special Resolution)

- Annexure C (For Ordinary Resolution)

- E-Form MGT 14 needs to be filed with ROC within 30 days from passing the Resolution.

- Fee for filing e-Forms in case of company have share capital.

| Nominal Share Capital (in Rupees) | Fee applicable |

| Less than 1,00,000 | Rupees 200 |

| 1,00,000 to 4,99,999 | Rupees 300 |

| 5,00,000 to 24,99,999 | Rupees 400 |

| 25,00,000 to 99,99,999 | Rupees 500 |

| 1,00,00,000 or more | Rupees 600 |

There will be a penalty for delaying the filing of MGT 14 within 30 days of passing the resolution.

What is PAS 3?

Purpose of the e-Form Whenever a company makes any allotment of shares or securities, it is required to file a return of allotment in e-Form PAS-3 to Registrar within thirty days of such allotment including the complete list of allotees to whom the securities have been issued.

Is PAS 3 Mandatory?

E-Form PAS-3 is required to be filed to ROC pursuant to Sections 39(4) and 42(9) of the Companies Act, 2013 and rule 12 and 14 Companies (Prospectus and Allotment of Securities) Rules, 2014 which are reproduced for your reference.

Information to be furnished in form PAS-3

Following information need to be entered in form PAS-3:

- Corporate Identification Number (CIN)

- Securities allotted payable in cash or for consideration other than cash

- Number of total allotments made

- Date of allotment

- Date of passing shareholders’ resolution

- SRN of Form No. MGT-14

- Nature of allotment i.e., preference shares/equity shares without differential rights or equity shares with differential rights or debentures

- Details of allotment

- Details of consideration

- Details of bonus shares

- Details of private placement

- The capital structure of the company after considering allotment.

- Debt structure of the company after considering allotment

- Whether complete list of allottees has been enclosed as an attachment.

What is SH-3?

Form SH-3 is Register of sweat Equity Shares dealt under section 54 of the Companies Act,2013 and Rule 8(14) of the companies (Share Capital and Debentures) Rules 2014. It means such equity shares are issued by a company to its directors or employees at a discount or for consideration other than cash, for providing their know-how or making available rights in the nature of intellectual property rights and values. This form contains the details of the allottees to whom sweat equity shares have been issued.

Why is Form SH-3 used?

The company shall maintain a Register of Sweat Equity Shares in Form SH-3 and shall forthwith enter therein the particulars of sweat Equity Shares issued under Section54. This is maintained at the registered office of the company or by any other person authorized by the board for the purpose. The entries in the register are authenticated by Company Secretary of the company or other person authorized by the board for the purpose.

Accounting Treatment

If the non-cash consideration takes the form of a depreciable or amortizable asset, it shall be carried to the balance sheet of the company in accordance with the accounting standards; or In other cases, it shall be expensed as provided in the accounting standards.

If sweat equity shares are not being issued for the acquisition of an asset, the accounting value of sweat equity shares shall be treated as a form of compensation to the employees or to the director, in the financial statements of the company. If sweat equity shares are being issued for acquisition of an asset, the value of the asset, as determined by the valuation report, shall be carried in the balance sheet as per the Accounting Standards and such amount of the accounting value of the sweat equity shares that is in excess of the value of the asset acquired, as per the valuation report, shall be treated as a form of compensation to the employee or the director in the financial statements of the company.

Note: The amount of sweat equity shares issued shall be treated as part of managerial remuneration for the purposes of sections 197 and 198 of the Act, if the following conditions are fulfilled, namely. –

the sweat equity shares are issued to any director or manager and they are issued for consideration other than cash, which does not take the form of an asset that can be carried to the balance sheet of the company in accordance with the applicable accounting standards.

Limits:

3 years – Lock in Period

- Other Company:

- 15% of paid-up capital

Or

- 5 crores (Whichever is higher)

Can be issue as sweat equity shares in 1 year.

- Provided that the issuance of sweat equity shares in the Company shall not exceed twenty five percent, of the paid-up equity capital of the Company at any time.

- Start Up Company:

- 50% of paid-up capital up to 10 years from Incorporation.

Taxability of Sweat Equity Shares in the hands of employees at the time of issue of sweat equity shares.

Whenever an employee receives sweat equity shares, the value of such shares will be taxable as a perquisite under the head salaries as per section 17 of Income Tax Act.

Section 17 defines perquisites which means benefits attached in addition to salaries and wages.

For e.g.: if rent free accommodation is provided to an employee it will be taxable under the head salary.

Taxable value of perquisite = (FMV-issue price) *no of shares allotted to him

How to determine fair market value?

It has to be calculated separately for listed shares and unlisted shares.

For unlisted shares: It has to be determined by a merchant banker as on the date of exercising the option or earlier date but not earlier than 180 days from the date of exercising the option.

MERCHANT BANKER is a person who provides financial and advisory services to help corporates to conduct business.

For listed shares: if the option is exercised on the trading day, then

Average price= (op price +cl price)/2

If the option is exercised on Non trading day then closing price of the preceding trading day shall be considered.

Here the word exercise means to put into effect the right to buy the shares at time of sale of such shares/securities.

*It may be noted that FMV as on the date of exercise of the option is relevant*

Taxability of Sweat Equity Shares at the time of Transfer.

Whenever the Sweat Equity Shares are transferred it is subject to Capital Gains Tax. In this regard the aspects to be noted are “Period of Holding” & “Cost of Acquisition”.

Period of Holding:

It shall be reckoned from the date of allotment or transfer of such equity shares.

Cost of Acquisition:

It shall be the FMV value as computed for determining the perquisite as mentioned above (Salaries).

Example:

A company X grants option to its employer R on 1st April 2015 to apply for 100 shares of the company for making available his intellectual property to the employer company at predetermined price of Rs 50/share. And the exercise period being 1st April 2016 to 31st march 2021.Employee R exercised his option on 31st march 2020 and shares are allotted to him on 3rd April 2020

FMV as follows:

01-04-2015. 01-04-2016 31-03-2020 03-04-2020

Rs 100 Rs 180 Rs 440 Rs 470

FMV on the date on which the option is exercised (440*100) 44000

Less the amount actually paid by the employee on respect

of such shares (50*100 shares) 5000

Value of perquisite will be 39000

For the purpose of computing capital gain at the time of transfer of these shares by Mr R. ₹ 44000(440*100) will be considered as the cost of acquisition.

What is ESOP?

ESOP (Employee Share Option Scheme) provides the existing employees the right to purchase a certain number of shares at a fixed price, sometime in the future. The main objective here is to align the company’s goals with that of the employees. Basically, since ESOP provides the option for employees to become future shareholders, they will perform for the betterment of the company, expecting that the overall performance will result in higher share prices. Like sweat equity shares, ESOP is also governed by the Companies Act, 2013. Accounting treatment and related guidelines for ESOP are explained in IFRS 2- Share Based Payments.

Sweat Equity Shares V/S ESOP?

Although there is a difference between Sweat Equity Shares and ESOP, both of them are two types of acts that a company can carry out to communicate that employees are valued and recognized. These types of schemes assist companies to retain valuable employees for a longer period of time and benefit from their efforts to improve company’s performance. Both Sweat Equity Shares and ESOP cannot be conducted through a preferential share allotment (the issue of shares or other securities by a company to any select person or group of persons on a preferential basis) since these shares cannot be issued to general shareholders.

By Krishna Priya C, Aparna Benny, Mohammed Ali K.N & K. Gopalakrishnan Nair FCS, FCMA, ACA, CAIIB.

Sec 2(88) of Companies Act, 2013 Defines Sweat Equity Shares “Sweat Equity shares means such equity shares as are issued by a company to itsdirectors or Employees at a discount or for consideration, other than cash, forproviding their know-how or making available rights in the nature of intellectualproperty rights or value additions.” Employees, Directors, KMP,…

- Audit & Assurance Services (1)

- Cyber Security (1)

- India Market Entry Services (1)

- Tax Related Services (1)

- Trading (2)